All Categories

Featured

Table of Contents

It is not going to be some magic path to wide range. It will assist you gain a little a lot more on your cash long-term. Naturally, there are various other advantages to any kind of entire life insurance policy policy. For instance, there is the fatality advantage. While you are attempting to minimize the ratio of premium to survivor benefit, you can not have a plan with absolutely no fatality benefit.

Some people marketing these plans argue that you are not disrupting compound passion if you obtain from your policy rather than withdraw from your savings account. That is not the case. It disrupts it in precisely the exact same way. The money you obtain out earns absolutely nothing (at bestif you do not have a clean funding, it may even be costing you).

That's it. Not so sexy now is it? A great deal of the people that buy into this idea also get right into conspiracy concepts concerning the globe, its federal governments, and its banking system. IB/BOY/LEAP is placed as a method to somehow stay clear of the globe's financial system as if the world's biggest insurer were not component of its economic system.

It is purchased the basic fund of the insurance company, which mostly purchases bonds such as United States treasury bonds. No magic. No transformation. You obtain a little greater rates of interest on your cash money (after the first few years) and maybe some property protection. That's it. Like your investments, your life insurance policy ought to be uninteresting.

Rbc Visa Infinite Private Banking Card

It feels like the name of this idea modifications when a month. You may have heard it referred to as a perpetual riches technique, household financial, or circle of riches. Regardless of what name it's called, infinite financial is pitched as a secret means to build wide range that just abundant individuals understand about.

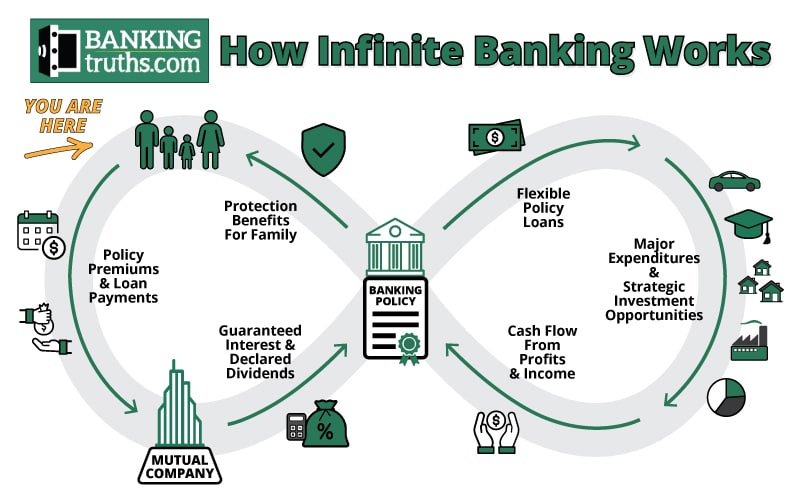

You, the policyholder, placed money into an entire life insurance policy through paying costs and acquiring paid-up enhancements.

How To Be Your Own Bank

The entire idea of "financial on yourself" only works since you can "bank" on yourself by taking car loans from the policy (the arrowhead in the graph over going from entire life insurance policy back to the policyholder). There are two different kinds of financings the insurance coverage firm may supply, either straight recognition or non-direct recognition.

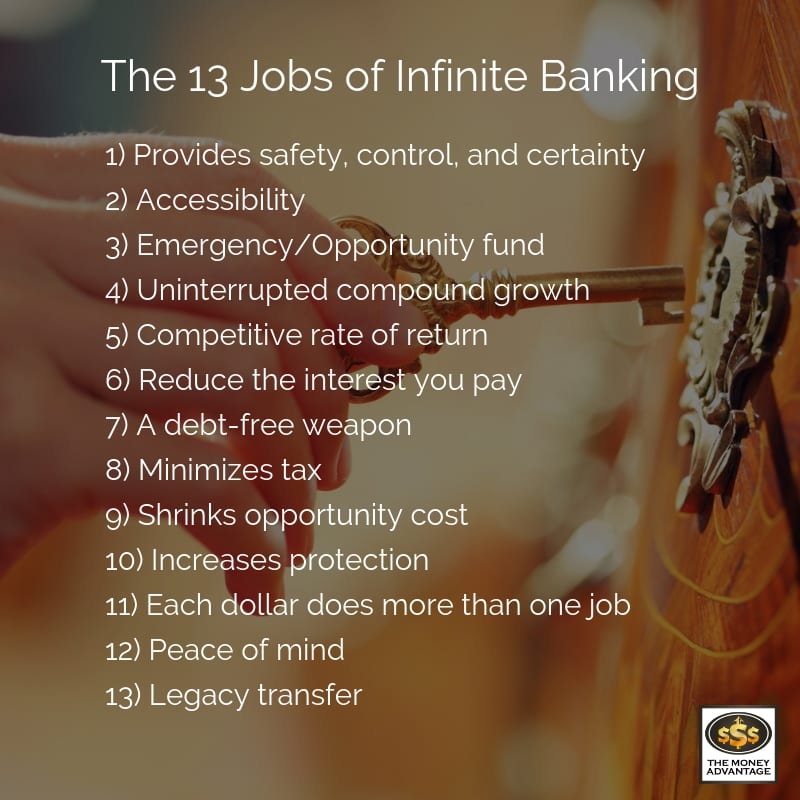

One feature called "wash finances" establishes the rate of interest on fundings to the same price as the dividend rate. This implies you can obtain from the policy without paying interest or receiving rate of interest on the amount you obtain. The draw of infinite banking is a returns rate of interest rate and assured minimum price of return.

The disadvantages of infinite banking are usually ignored or otherwise mentioned whatsoever (much of the details offered about this principle is from insurance policy representatives, which may be a little prejudiced). Just the cash money value is growing at the dividend price. You also need to spend for the cost of insurance policy, fees, and expenses.

Every permanent life insurance policy is different, yet it's clear someone's total return on every dollar spent on an insurance policy product could not be anywhere close to the reward rate for the plan.

Become Your Own Bank Book

To give a very fundamental and hypothetical instance, let's assume somebody has the ability to make 3%, usually, for each buck they spend on an "unlimited financial" insurance policy product (after all expenses and costs). This is double the approximated return of entire life insurance policy from Consumer Reports of 1.5%. If we assume those bucks would go through 50% in tax obligations complete otherwise in the insurance coverage item, the tax-adjusted price of return might be 4.5%.

We think greater than typical returns overall life product and an extremely high tax obligation price on bucks not take into the policy (which makes the insurance item look better). The truth for lots of individuals might be even worse. This pales in comparison to the long-lasting return of the S&P 500 of over 10%.

Infinite Banking Insurance Companies

At the end of the day you are acquiring an insurance policy product. We like the security that insurance policy supplies, which can be gotten a lot less expensively from a low-cost term life insurance policy. Overdue car loans from the policy may additionally lower your death benefit, reducing an additional level of protection in the plan.

The principle only works when you not just pay the substantial costs, yet make use of extra money to acquire paid-up additions. The opportunity price of all of those bucks is remarkable incredibly so when you could rather be buying a Roth Individual Retirement Account, HSA, or 401(k). Even when compared to a taxed financial investment account and even a cost savings account, unlimited banking may not supply similar returns (compared to investing) and equivalent liquidity, access, and low/no fee structure (compared to a high-yield interest-bearing accounts).

When it comes to economic preparation, entire life insurance policy often stands out as a prominent alternative. While the idea could appear appealing, it's important to dig much deeper to understand what this actually indicates and why watching whole life insurance coverage in this way can be misleading.

The idea of "being your very own bank" is appealing because it suggests a high degree of control over your financial resources. This control can be imaginary. Insurer have the utmost say in how your policy is taken care of, consisting of the terms of the car loans and the prices of return on your money value.

If you're thinking about entire life insurance policy, it's necessary to watch it in a wider context. Entire life insurance policy can be a useful tool for estate planning, providing an ensured survivor benefit to your recipients and potentially offering tax obligation advantages. It can also be a forced savings vehicle for those that battle to save money continually.

Nelson Nash Net Worth

It's a form of insurance policy with a financial savings element. While it can offer stable, low-risk development of cash worth, the returns are generally less than what you may accomplish through other investment cars. Prior to delving into whole life insurance policy with the idea of boundless financial in mind, make the effort to consider your monetary goals, danger resistance, and the full series of financial products readily available to you.

Boundless financial is not a monetary cure all. While it can work in particular scenarios, it's not without threats, and it calls for a considerable dedication and comprehending to manage properly. By recognizing the possible challenges and comprehending the real nature of entire life insurance policy, you'll be much better geared up to make an informed choice that supports your financial wellness.

This publication will educate you just how to set up a financial plan and how to make use of the banking policy to spend in realty.

Boundless financial is not a services or product supplied by a details establishment. Boundless banking is a method in which you buy a life insurance policy policy that collects interest-earning cash value and obtain lendings against it, "obtaining from yourself" as a resource of capital. Then eventually pay back the loan and begin the cycle all over once again.

Pay policy premiums, a part of which develops cash worth. Cash money worth makes intensifying passion. Take a car loan out versus the policy's cash worth, tax-free. Pay back lendings with passion. Money value collects again, and the cycle repeats. If you use this concept as planned, you're taking cash out of your life insurance policy policy to buy everything you would certainly need for the rest of your life.

Latest Posts

Privatized Banking Policy

Bank On Yourself For Seniors

Infinity Life Insurance